Small Enterprise House owners: You are able to do this!

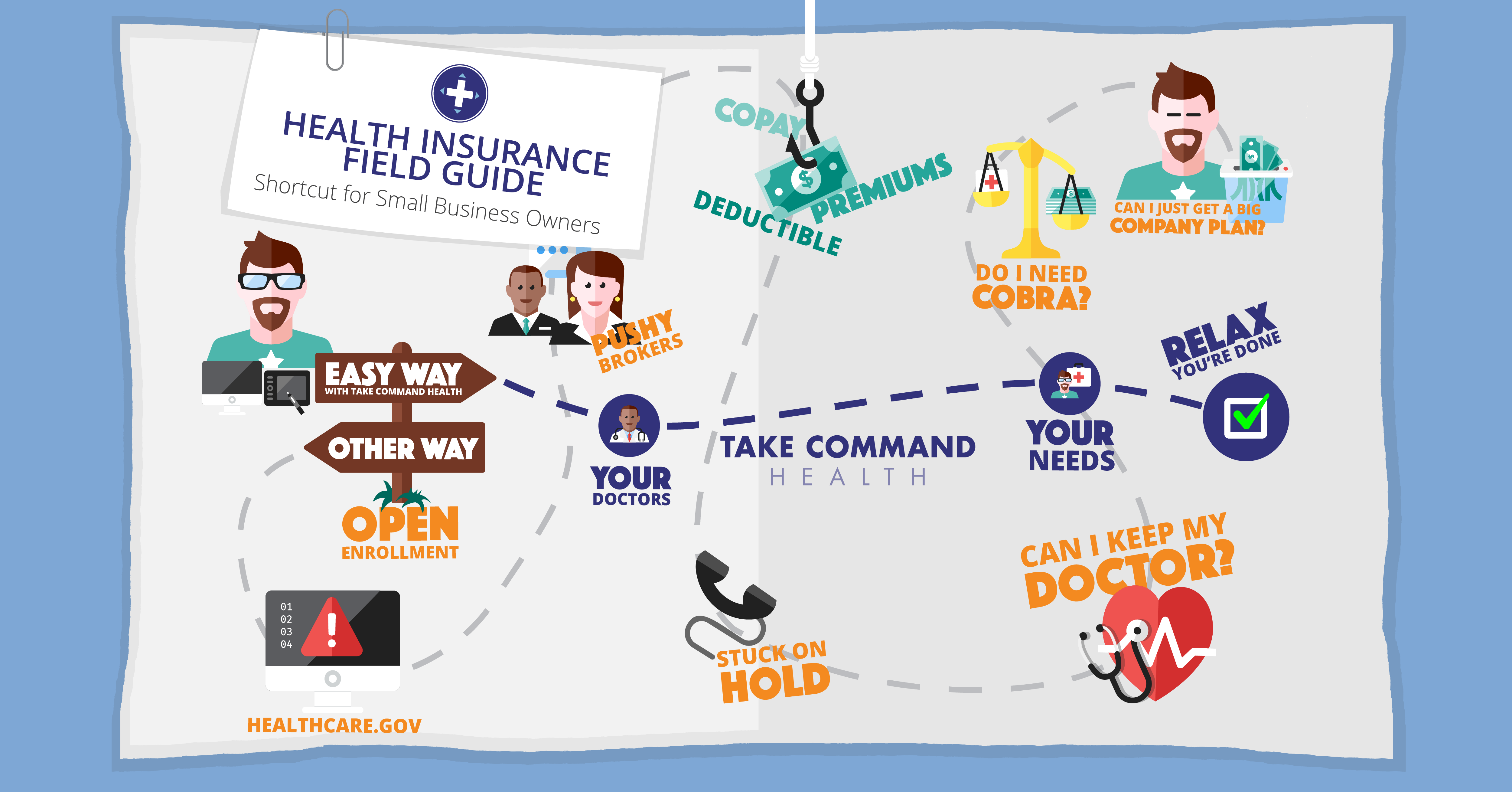

You took the initiative to begin your personal enterprise. You are a self-taught grasp at hiring, firing, negotiating, stock, accounting, and all the pieces else as a result of as a small enterprise proprietor it’s a must to be. However there’s one lingering factor annually you’re feeling somewhat uneasy about–choosing a well being plan. Your company associates complain about medical health insurance, however they do not actually know what it is prefer to be completely on their very own such as you do. The fact is purchasing on the person market might be overwhelming:

Am I getting the protection my household wants? Will my physician I’ve seen for 20 years take my new insurance coverage? What about my prescriptions? Am I getting offered one thing I don’t really want or am I lacking one thing I desperately do? What about my staff?

At Take Command Well being, our job is to empower you to make good medical health insurance selections and make your busy life somewhat simpler. A good move not solely provides you peace of thoughts, it’ll additionally prevent cash. Analysis reveals greater than 85% of individuals purchasing on their very own select the fallacious well being plan annually, costing greater than $500 in pointless well being bills.

Let’s do it. Let’s discover an superior plan this Open Enrollment with no head-aches that has precisely what you want. We created this information and seven easy medical health insurance purchasing guidelines to arm you with the within data you must make a good move for you and your loved ones.

If you wish to skip the studying, you’ll be able to simply click on this “Let’s Go” button and belief our step-by-step information to stroll you thru the method. In case you’re the analytical kind, scroll down and preserve studying how we use knowledge science to assist individuals enhance plan selection:

8 guidelines for looking for medical health insurance

1. All the time Store Each 12 months

It’s tempting to need to stick to one plan out of comfort, and the considered making an attempt one thing new might be intimidating. This isn’t one thing that may be on auto-pilot. Plans, physician networks, prescription protection and your loved ones’s well being wants are altering yearly. To not point out, the market is altering considerably attributable to a number of rising developments (click on right here to study extra.) What was nice one 12 months could also be horrible the following, and insurance coverage firms are regularly shifting issues round to maximise their earnings—not essentially your well being.

Right here are some things to remember:

- NEVER let your self get auto-renewed in a plan: 80% of plans could have a big change annually that you could be not concentrate on.

- In case you’re leaving an organization and COBRA is an possibility, 99% of the time, COBRA is a foul deal. Don’t simply settle for it as a result of it’s straightforward. Right here’s why.

Plan on taking 20 minutes to assessment and re-shop your plan annually throughout Open Enrollment. At worst, you’ll have peace of thoughts realizing your present plan nonetheless works. At greatest, you’ll discover one thing higher and save your self some huge cash and complications.

2. Actually know the lingo

The language of medical health insurance is acquainted and complicated on the identical time. Phrases like deductible, premium, copay, and so on. get thrown round in conversations with colleagues and by actually subtle entrepreneurs that the insurance coverage firms rent. We suggest our Insurance coverage 101 Information to assist clarify all of the fundamentals. Nonetheless, we would like you to really feel like an knowledgeable and which means understanding how these phrases actually affect plan selection.

Listed below are just a few of the most typical pitfalls we see annually:

“I would like a plan with a low deductible”

We’re programmed to assume that we don’t get something earlier than the deductible (in all equity, it was this manner for a few years). Nonetheless, with particular person plans, all of your preventive care is roofed earlier than the deductible. Meaning all your annual physicals, screenings, immunizations, flu photographs, and so on. price $0. You might see the physician a number of occasions a 12 months, get month-to-month prescriptions, and by no means contact your deductible since you need not. Plans with low deductibles are very costly and barely greatest. As a substitute, deal with extra necessary numbers like estimating your price of care (see beneath) and the max-out-of-pocket restrict.

“I would like a low copay”

Insurance coverage firms have accomplished a lot of analysis and know that people pay probably the most consideration to a plan’s deductible and first care go to copay when selecting a well being plan—and they’re going to use fancy advertising and marketing to trick you. Aetna had a sequence of plans not too long ago with names just like the “Aetna $15 copay Bronze Plan.” Right here’s what occurs. The $15 covers the price of the physician go to solely. Actually, simply the 20 minutes the physician spends speaking to you. Recall from above, in the event you’re seeing the physician for a screening or annual bodily, that is $0. In case you’re sick or injured, you’ll nearly definitely want a strep check, bandages, lab work, and so on. that isn’t topic to the $15 copay. We see shoppers get pissed off by $200 payments that they thought had been going to be $15.

As well as, copays don’t depend in direction of your deductible. That’s an enormous shock to most folk, however we promise it’s true. When you’ve got a plan with a $1000 deductible and a $500 ER copay and must go to the ER for one thing minor, you’ll pay $500 it doesn’t matter what (even when it wouldn’t have been that a lot in the event you simply paid money) and could have paid $0 in direction of your deductible.

“I would like a plan that covers my prescription”

Right here’s rule of thumb: in the event you take a name-brand treatment, then, sure, you do want to ensure it’s coated by your plan. Nonetheless, most upkeep medication can be found in generics. Many individuals assume they take a reputation model once they’ve truly been taking the generic for years. Most generics have a really reasonably priced money value. We had one shopper—a really good woman—who insisted she wanted an costly Silver plan that was going to price her $250 extra a month as a result of it had a $15 copay for her drug. Properly, we discovered her drug price $8 money at her native pharmacy. Ensure to verify the money value of your prescriptions! You will discover extra recommendations on saving in your drugs right here.

“I would like a PPO”

Perhaps you do, however you might also be means over-paying. Please see rule #5 beneath.

“My physician received’t take any ‘change’ (Healthcare.gov) plans”

We hear this loads, typically from front-office employees or medical doctors who could also be nice physicians however don’t perceive their insurance coverage contracts. The fact is that medical doctors (or their hospital programs in some circumstances) negotiate with insurance coverage firms, not with plans which are on or off-exchange. In case your physician has negotiated with an insurance coverage firm to just accept one among their networks, it doesn’t matter in the event you purchase your plan on the change (Healthcare.gov) or on a non-public change.

3. Think about ALL of your medical health insurance choices

There are a number of methods to buy medical health insurance. While you store at Healthcare.gov, you’re solely seeing “on-exchange” plans. Nonetheless, insurance coverage firms solely make a fraction of their plans out there “on change.” In case you go on to an insurance coverage firm’s web site, you’ll see their “off-exchange” plans. There are additionally non-public exchanges, co-ops, and even faith-based “medical sharing” plans that operate just like insurance coverage. At Take Command Well being, we will help you rapidly see ALL of your choices.

Particular Be aware: Chances are you’ll get approached by aggressive brokers that need to promote you short-term medical insurance coverage or “indemnity” plans. They may sound too good to be true, and they’re. Brief-term medical plans are reasonably priced and do an honest job of defending you from damage and sickness. They’re horrible for pre-existing situations or routine care. So why not string collectively a sequence of short-term plans like some brokers suggest? Properly, short-term plans don’t depend as insurance coverage. Sure, you get a decrease premium, however then you definitely’ll get hit with some hefty tax penalties if you file your taxes. Solely use short-term plans for 3 months or much less (the tax penalty grace interval) when you have a singular scenario. By no means by no means by no means purchase an indemnity plan and run from whoever is promoting it to you. Indemnity = pure snake oil.

4. Do not purchase primarily based on concern of the unknown

Many individuals get overwhelmed making an attempt to “store” for medical health insurance as a result of they really feel like predicting the long run is unattainable:

How do I do know what’s going to occur to me this 12 months?

What if I get actually sick or injured?

You do not have to foretell the long run, simply stick to what you already know. Statistically, over 75% of your prices within the subsequent 12 months are predictable primarily based in your recognized wants. In that case, what actually drives prices, and due to this fact your plan selection, are the issues you already know about: prescriptions, medical doctors visits, remedy, medical gear, and so on. In case you’re wholesome, perhaps you intend on none of this stuff–which is simply as necessary to know.

At Take Command Well being, you’ll be able to rapidly seek for your prescriptions or inform us about any well being wants you’re managing corresponding to “bodily remedy” or “having a child.” We’ll run all of the numbers for you and allow you to estimate your out-of-pocket prices on every plan.

However what about if somebody in my household will get severely damage or injured? Making use of some extra knowledge science, in a given 12 months you have got < 1% probability of experiencing a “catastrophic” accident or sickness. Additionally, it does not actually matter a lot (financially, a minimum of), as a result of in the event you get a big hospital invoice, you may find yourself paying your plan’s max-out-of-pocket restrict after which no extra:

Let’s say you have got a foul 12 months and rack up a $200,000 hospital invoice. The one quantity you need to care about is your plan’s max-out-of-pocket restrict. Your whole spend for that 12 months could be premiums * 12 + max-out-of-pocket.

Right here’s a sneaky secret: in the event you run this equation for each plan in the marketplace, they are going to all be actually shut collectively. Due to this fact, catastrophic incidents (or concern you might expertise one) ought to by no means drive plan selection.

5. Know which medical doctors you actually want

This 12 months, we’re seeing plenty of new EPO networks. With an EPO, you don’t want a main care physician and you may see any specialist you’d like that’s in-network. The one distinction between an EPO and a PPO is that an EPO doesn’t cowl out of community advantages. However so long as you’re good about selecting a plan that has your medical doctors in community, this generally is a nice cash saving alternative!

In case your medical doctors occur to be in an HMO or in the event you don’t have most well-liked medical doctors but, the HMO generally is a nice cash saving selection. These aren’t the HMOs of the previous with lengthy wait occasions and lengthy traces. You may get referrals on-line (verify along with your supplier) and going to see some specialists (like an OBGYN) not requires a referral.

At TakeCommandHealth.com, now we have a first-of-its-kind common physician search software. Seek for your medical doctors and we’ll allow you to discover the least costly networks and plans she or he accepts!

6. By no means purchase dental insurance coverage

Dental insurance coverage is now nearly fully separate from medical health insurance and it’s nearly all the time a foul deal! Conventional dental insurance coverage solely works if somebody (like an organization) helps you pay for it. In any other case, in the event you take the time to learn the wonderful print, you’ll understand that with ready durations, most limits, and exclusions, it’s very very laborious to get extra out of your dental insurance coverage than you place in. We evaluate it to an costly layaway plan or pawn store. They maintain your cash, cost you curiosity and costs, after which offer you somewhat bit again if you go to the dentist. Brokers get HUGE commissions for promoting dental insurance coverage as a result of it’s a money-maker for the insurance coverage firms.

As a substitute, we suggest low cost dental plans. Low cost plans will not be insurance coverage–they’re extra like wholesale membership memberships. You pay an annual charge and also you get entry to the identical dentists and identical charges as individuals who buy conventional dental protection. There are numerous low cost dental plans and it’s straightforward to seek out one which your dentist works with. And get this: an annual membership prices the identical as about two months of dental insurance coverage.

At TakeCommandHealth.com, we’ve arrange partnerships with a number of low cost dental suppliers. We will help you discover your dentist and get you enrolled. (It’s separate out of your medical health insurance plan.) That recommendation alone will prevent about $30/mo per individual. You’re welcome!

7. Reap the benefits of HSAs and tax credit

One method to pay an excessive amount of for medical health insurance is to go away cash on the desk. In Texas final 12 months, a minimum of 600,000 Texans may have claimed a tax credit score however didn’t. A part of the explanation Texans left this cash on the desk is as a result of going via Healthcare.gov might be difficult–so many individuals didn’t know they had been eligible!

In case you do make an excessive amount of cash for a credit score, then you need to most likely think about using a Well being Financial savings Account (HSA). HSAs permit you to pay to your care with tax-free {dollars}. For top-earners in a better tax bracket, that’s like a 30 to 35% low cost on well being prices!

Our advice engine can rapidly decide in case you are eligible for tax credit and routinely apply them to your plan every month. We can even allow you to resolve if an HSA plan is an efficient match for you. Fairly superior.

8. Reimburse your staff tax-free for healthcare prices with QSEHRA

As a small enterprise proprietor with fewer than 50 staff, you’re eligible for tax-free reimbursements in your medical health insurance premiums and medical bills via a Certified Small Employer Well being Reimbursement Association (QSEHRA). Relying on how your corporation is about up- sole proprietorship, S-Corp, C-Corp, and so on you’ll be able to decide proprietor eligibility to take part. QSEHRAs are an effective way to supply well being advantages to staff at a predictable price.

Why use Take Command Well being?

Take Command Well being believes in transparency and empowerment on this complicated realm of medical health insurance. We use knowledge to supply unbiased data for on- and off-market plans in addition to faith-based plans. We need to empower you to make good selections and keep away from losing cash on the fallacious plan.

We stand behind our product too. When you’ve got any questions, be at liberty to e mail us at assist@takecommandhealth.com or click on the button beneath to provide our on-line medical health insurance purchasing software a attempt.